Today’s healthcare landscape is constantly changing and one of the best ways to pave a successful path forward is with data analytics. Through data tracking and analysis, providers can optimize patient care and increase revenue by using current, available resources. By leveraging their data through advanced analytics, medical providers can make more informed decisions, optimize their business operations, and boost financial performance.

As discussed in a previous blog post, Revenue Cycle Management (RCM) drives a business. Once a patient is scheduled, there are many steps involved to ensure a final payment is received for services provided. Extracting and analyzing revenue cycle data from such areas as patient registration or claim denials, can improve processes within the RCM by addressing such things as staff efficiency or coding errors.

Solving Problems Through Data

Analytics in healthcare is the systematic use of data and statistics to gain further insight into business operations. To implement effective changes to any practice, it is important to understand the root cause of operational or financial problems. By analyzing data, medical providers can identify trends, uncover hidden patterns, and make data-driven decisions that can significantly impact their bottom line.

Inefficient RCM can lead to a significant loss in revenue and temporary fixes or budget adjustments will not always solve problems in the long term. To identify where to fix the problems, it is necessary to do a deep dive into the operations data. For example, reviewing all claim denials from the past year can pinpoint areas of improvement to help streamline income. Denials due to mistakes in patient registration or underpayments by an insurance company can be signs of consistent, unresolved errors or issues. Once you understand the data, you can pinpoint the areas of improvement in the revenue cycle and implement changes quickly and successfully.

Enhancing Revenue Cycle Management

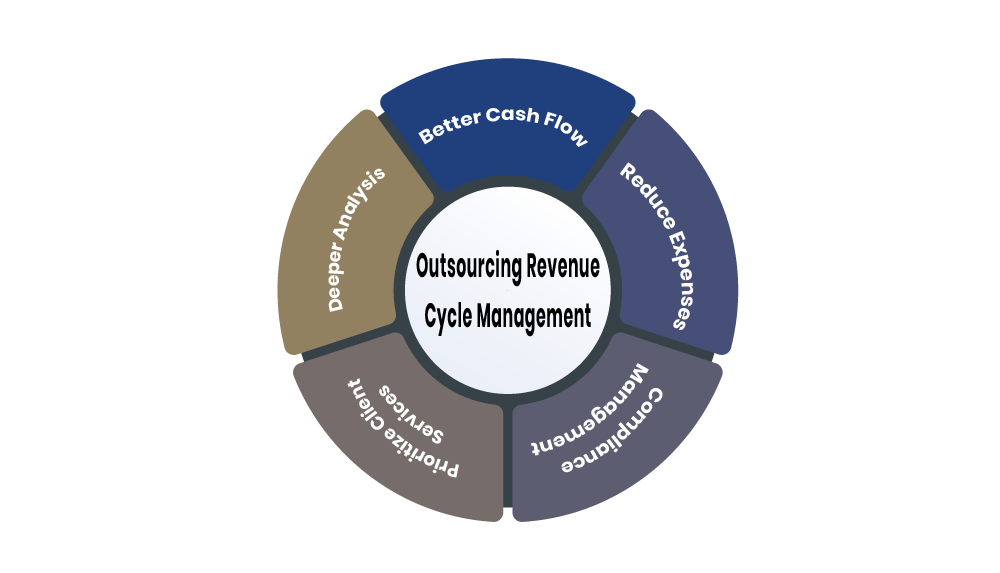

Data analytics can reform the financial health of a company by collecting, understanding, and interpreting the unique data points that make up the business. Data provides insight into where and how current RCM strategies are working or falling short. Effective revenue cycle management is essential for maintaining a healthy cash flow, maximizing revenue, and creating transparent billing practices for patients. Analytics can provide valuable insights into various aspects of RCM, help providers identify areas for improvement and implement strategies to enhance financial performance.

Data analytics can revolutionize current RCM practices and change how providers manage their business. Successful implementation of actionable insights can create workflow efficiency, reduce revenue leaks, and streamline billing processes.

How ZMark Can Help

At ZMark Health, we work with providers and organizations to track revenue and improve clinical processes using data analytics. For example, by understanding the workflow between a provider and insurance companies, we help create methods to monitor gaps in data and implement changes to reduce denials and follow-ups.

Additionally, ZMark helps clients understand the relationship between clinical processes, EHR usage and data, which allows an organization to make operational changes that support more accurate and transparent reporting capabilities. When asked about data analytics, ZMark Health Director of Advisory Services Jennifer Short offered this insight: “ZMark has worked with organizations of all sizes, and in multiple healthcare industries, to increase efficiencies in operational processes which leads to enhanced visibility into data analytics and more accurate and transparent reporting. Our goal is to help our clients learn, grow and become able to maintain these new processes on their own.”

If you’re interested in learning more about how data analytics and simple changes in your RCM can transform your organization, reach out to ZMark Health today to get started!